[Note: In this article, the word "Church" does not refer to any physical building, but refers to the whole body of believers in Christ. The word "church" is translated from the Greek word ekklesia, which literally means "assembly" or "congregation" of people; it does not refer to any physical building. Keep that in mind when reading this article]

Joshua challenged the people: "choose you this day whom ye will serve." (Joshua 24:15). Today, government is demanding a similar choice. Today the world assumes that the church is the church because it is registered with, and defined by, the State.

The following is intended merely to provide an overview, an introduction to the whole issue of the Church and incorporation. In addition, its purpose is not meant to be a criticism of the many well meaning Christian men and women who have laboured for the Lord in these matters, but simply as a supplemental guide for the avoidance of "rendering unto Caesar" that which is not and should not be his. We shall endeavor to explore the relationship between, churches and corporations.

So what exactly is incorporation? What really happens to a church that becomes incorporated? Are there biblical principles against incorporation?

First of all, let us define the word "corporation." In the strict everyday definition of the word, a corporation is "a group of people combined into or acting as one body." This word is derived from the Latin word "corpus," which means "body." In this sense, the Christian Church is indeed a corporation. It is the "corpus Christi," the "Body of Christ." It derives its existence and authority from its Head, the risen and victorious Son of God. It is comprised of individual members who have covenanted together to further Christ's Kingdom by the preaching of the Gospel and the discipling of the nations (Matthew 28:19-20).

Christ is Sovereign over his Church

The Church's "corporate status" is well-established in Scripture: Matthew 16:18, 1 Corinthians 12:12-14, 27, Ephesians 1:22; 5:23b, 30, Colossians 1:18; 2:19 teach that Christ is clearly the head of the church, and we are all members of his body.

The Church is the visible manifestation of Christ's Kingdom on earth. However, as Jesus Himself stated, "My Kingdom is not of this world" (John 18:36). Many Christians have misunderstood this verse to mean that neither the Church nor individual Christians should involve themselves with the affairs of the world. In what is known as "pietism," a false dichotomy is erected between the "spiritual" Kingdom and the "carnal" world.

Of course, this is not what Jesus had in mind at all. He very explicitly stated elsewhere that Christians are to act as the "salt" of the earth and as a "light" in the world by permeating society and working to change it from within (Mat.5:13-16). This task of dominion is accomplished through the work of evangelism and discipleship, as Jesus commanded in the Great Commission. The Christian's purpose is indeed "worldly," insofar as it is involved in bringing the world into subjection to the Word of God (2 Cor.10:5).

Thus, the true meaning of Jesus' declaration that His Kingdom is "not of this world," is that it does not derive its authority and power from the world or its institutions. The Church is indeed a spiritual organization, but this simply means that it is "of the Spirit"-- it relies upon the Holy Spirit and the inspired Word for its existence, not upon the efforts or laws of men. This important detail should be kept in mind as we further study the subject of church incorporation.

The State is Sovereign over its Corporations

Having briefly examined the biblical definition of a corporation, let us now look at the legal definition of a corporation. According to the U.S. Supreme Court:

1. "A corporation is a creature of the state. It is presumed to be incorporated for the benefit of the public. It receives certain special privileges and franchises and holds them subject to the laws of the state and the limitation of its charter. Its powers are limited by law. It can make no contract not authorized by its charter. Its rights to act as a corporation are only preserved to it so long as it obeys the laws of its creation. There is a reserved right in the legislature to investigate its contracts and ascertain if it has exceeded its powers" (Hale v. Henkel, 201 U.S. 43).

2. "[A corporation is] an artificial person or legal entity created by or under the authority of the laws of a state. An association of persons created by statute as a legal entity.... The corporation is distinct from the individuals who comprise it (shareholders).... Such an entity subsists as a body politic under a special denomination, which is regarded in law as having a personality and existence distinct from that of its several members." Black's Law Dictionary West Publishing Company, 1991; 6th Edition, page 340.

3. "A corporation derives its existence and all of its powers from the State and, therefore, has only such powers as the State has conferred upon it. Power is used here to mean the legal capacity to execute and fulfill the objects and purposes for which the corporation was created, and the source of this power is the charter and the statute under which the corporation was organized." Len Young Smith and G. Gale Roberson, Smith and Roberson's Business Law, West Publishing Company, 1966, page 796.

Note: A corporation is created by, and derives its existence from, the State. In contrast, the church is created by, a creature of, derives its existence from, subject to, and obeys the Law of, Jesus Christ.

4. "Corporate existence is a privilege granted by the sovereign upon compliance with specified conditions" Len Young Smith and G. Gale Roberson, Smith and Roberson's Business Law, West Publishing Company, 1966, page 931. .

5. "Corporations are not citizens.... The term citizen... applies only to natural persons... not to artificial persons created by the legislature" Paul v. Virginia, 8 Wall. 168, 177; see also the Opinion of Field, J., in the Slaughterhouse Cases, 16 Wall.36,99.

Note: God teaches that Christians, his church, are citizens of the household of God (Eph.2:19, Phil.3:10).

6. Every corporation has obtained a charter from the State of Incorporation. This charter is simply permission to exist given to the corporation, without which, its operations would be considered illegal. In addition to the charter are the articles of incorporation: "The objects or purposes for which a corporation is formed are expressly stated in its articles of incorporation, which delineate in general language the type of business activities in which the corporation proposes to engage" Smith and Roberson's Business Law, West Publishing Company, 1966, page 798.

Note: Is the church of God involved in any type of business activities? (Matthew 21:12, John 2:16).

7. "Instances of non-profit corporations are educational institutions, athletic clubs, library clubs, fraternities, sororities, hospitals, and organizations which have exclusively a charitable purpose" Smith and Roberson's Business Law, West Publishing Company, 1966, page 789.

The reader will notice that "churches" are conspicuously absent from this list of non-profit corporations. That is because our law-makers are fully aware that incorporation involves creation, and the Church simply cannot be created by the State. Furthermore, the Church's ordained purpose of preaching the Gospel can never be illegal, so no special license is required from the State to do so.

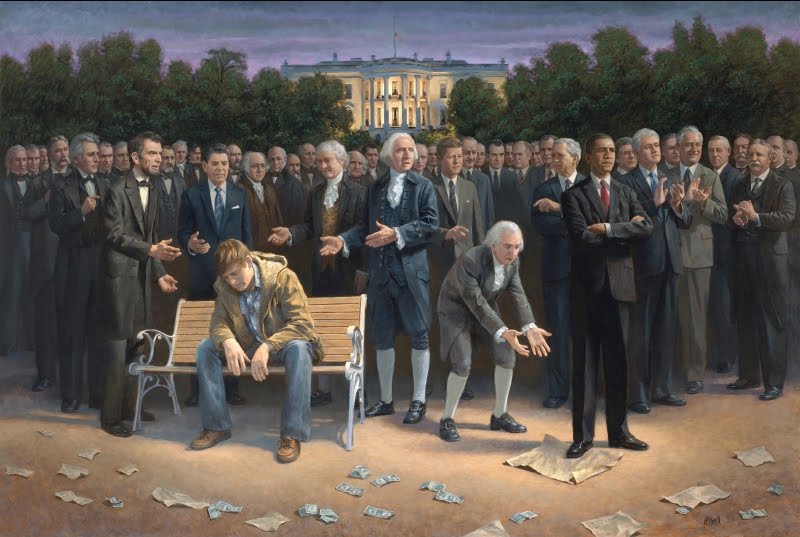

Though not all of our founding fathers were genuine Christians, they nevertheless understood that the Church of Christ is under the sole jurisdiction of its Lord, and that the civil magistrate therefore should not dare to encroach upon that authority. Because of this healthy respect for the Church, the very first sentence of the Bill of Rights reads as follows:

"Congress shall make no law regarding an establishment of religion, or prohibiting the free exercise thereof" (U.S. Constitution, First Amendment).

According to Supreme Court Justice Hugo Black: "The establishment clause of the First Amendment means at least this: Neither a state nor the federal government can set up a church" Everson v. Board of Education, 1947).

It was one of the principles of the sixteenth-century Reformation that the Church and the State are separate governments, and that, although they are to work together for the furtherance of God's Kingdom, they are not to either merge with one another or usurp the sphere of authority of one another (Westminster Confession of Faith, Chapter XXIII:3) The Church is forbidden by Scripture to take up the State's "sword" (Romans 13:4), and the State is likewise forbidden to assume the Church's "keys" (Matthew 16:19). However, as we will see, the latter is precisely what occurs whenever a church seeks incorporation at the hands of the State.

Is a Church required to Incorporate under the Government?

According to the Internal Revenue Code, "a church, its integrated auxiliaries, and conventions and associations of the church are excluded from taxation." United States Code, Title 26, § 508(c)(1)(A).

Section 508(c) of the Internal Revenue Code provides that churches are not required to apply for recognition of Section 501(c)(3) status in order to be exempt from federal taxation or to receive tax deductible contributions. Churches are automatically exempt from Federal income tax, and contributions to churches are deductible by donors under section 170.

Elsewhere, the IRS states: "Although a church, its integrated auxiliaries, or a convention of churches is not required to file Form 1023 to be exempt from federal income tax or to receive tax deductible contributions, such an organization may find it advantageous to obtain recognition of exemption (Tax Exempt Status for Your Organization, IRS Publication 557).

Just what "advantage" is there for a church in obtaining 501(c)(3) recognition and thereby exchanging its sovereignty for a subordinate status in relation to the federal government? Most people would answer that such grants the church exemption from taxation. However, we have already seen that the federal government has never been able to tax the Church of Christ; the Church is not exempt from taxation, it is immune. The "advantage" is something else entirely:

"By establishing its exemption, potential contributors are assured by the [Internal Revenue] Service that contributions will be deductible" Tax Exempt Status for Your Organization, IRS Publication 557.

The tragic irony of all this is that, according to the Internal Revenue Code, financial donations to an unregistered, unincorporated church are automatically tax-deductible (26 USC 170-B)! But is this biblical?

"God loveth a cheerful giver." (2 Corinthians 9:7). But the government promises, "Incorporate, and I will return to you up to thirty-five percent of your tithes and offerings!" And the Bridegroom wept. Now Jesus knows that His bride "purposeth in [her] heart . . . grudgingly, or of necessity." (2 Corinthians 9:7). God had no respect towards Cain's offering because he did not give from the heart (Gen.4:3-6).

The IRS, of course, knows very well that it has no constitutional authority over the Church, and that it may not violate the First Amendment protection against government interference with the Church. In fact, the IRS may not violate the constitutionally secured rights of any American Citizen or group of Citizens, and is able to gain jurisdiction only when such is given to it voluntarily. Thus, the IRS holds out the unbiblical "advantage" of 501(c)(3) corporate status as bait to clergy ignorant of the law in hopes that these men will "bite," thereby placing themselves and their congregations firmly on its jurisdictional hook.

Once the bait has been taken, and the catch is reeled in, another church has been transformed into a "legal fiction" subject to the tyrannical control of the federal government. The truth is that "incorporated churches" are not, by definition, churches at all! They are merely "non-profit organizations" (or should I say "non-prophet organizations"). The truth is, any "church" that is incorporated has deposed Jesus Christ from His rightful position as Head over His own Body and has surrendered that Body to the dominion of the State.

The truth is, "incorporated churches" are subject to total governmental control -- whom they may hire, what they may and may not teach and preach, they cannot conflict with "public policy" nor assault the hearer's sense of mental well-being, self esteem, sexual orientation, etc. The IRS prohibits such organizations from "carrying on propaganda, or otherwise attempting to influence legislation" (26 USC 501-C-3). This prohibition extends, not only to the endorsement of a political candidate, but also any other attempts to "influence legislation," including taking a public stand against such government-protected abominations as abortion or homosexuality. Now, the church is discovering that favors from Washington, DC have strings attached. In this case, the string is a rope that is being used to throttle her once-powerful voice, to squeeze out her very life and, eventually, to hang her by the neck until dead!

Should the Bible itself one day be ruled by the government to be "politically incorrect," incorporated churches will find themselves on the horns of a very serious dilemma. After all, in a civil suit, a corporation's defense is limited to the terms specifically enumerated in its charter and articles of incorporation. All other "extrinsic evidence," including the Bible or any historical Christian creeds or standards, will be disallowed in a State court case, because they are "not contained in the body of [the] contract." (Black's Law Dictionary, p. 588). Outside of its own walls, the incorporated church may not stand on the authority of the Scriptures regarding any political or civil issue, because it is bound by the "higher laws" of the State. Consequently, the Christian Church in America, little by little, ceases to be the "salt" and "light" to society that it was commanded to be (Mat.5:13-16). And all this for a simple tax deduction! Because of money! This directly contradicts Jesus' teaching, "make not my Father's house an house of merchandise" (John 2:16).

Operating as a Government Business

There are profit-making businesses and there are non-profit businesses, but a business is a business in the eyes of government. An incorporated church simply cannot deny the fact that it has requested permission of the State to operate as a business. Not only does it have its charter and articles of incorporation on file with the Secretary of State, but it is also required to list a President, Vice-President, Secretary, and Treasurer. None of these offices were instituted by Christ in His Church (Eph.4:11-12), because they exist to control the business dealings of a corporation, not the sacramental duties of the Body of Christ.

Many churches, since 1984, have begun to list the minister and other ecclesiastical leaders as "employees" for Social Security purposes. The IRS exists to regulate revenue which is internal to the federal government. Consequently, in the Internal Revenue Code, an "employee" is specifically defined as follows: "an officer, employee, or elected official of the United States, a State, or any political subdivision thereof" (26 USC 3401-C). By listing the minister as an "employee" who earns "income," the incorporated church is unknowingly identifying him as one who works for the federal government. A free, unincorporated church cannot be held to the standards of a corporation doing "business" as a church. A church congregation is a private assembly of individuals, coming together as a family, to worship their Lord. Biblical worship is not a "public" activity. Jesus Christ, not the State, ordained the assembling together of believers.

Subject to Taxation Via Social Security

Yet another indication that an incorporated church is a government agency is its participation in Social Security. Seen in this light, payment into Social Security by incorporated churches brings us to an astonishing conclusion: Incorporated 501(c)(3) churches are not exempt from taxation after all! It is an established legal principle that "the power to tax is the power to destroy." The government only has the power to destroy that which it has created.

Another related issue here is that of the "corporate franchise." According to law, "a corporation must have a franchise" (Len Young Smith and G. Gale Roberson, Smith and Roberson's Business Law, p. 786.) In the case of an incorporated church, who are its franchises? If you guessed the members of the congregation, you are correct. In fact, they are legally "shareholders" in the business. This is proven by the fact that the so-called "congregational meetings" of the incorporated church must follow the legal guidelines of any other corporate meeting. For example, motions must be made and minutes must be kept of the proceedings. By-laws must be maintained and any additions (amendments) must be voted on by the members of the church.

Furthermore, at the end of the year, members and contributors will receive an itemized report of their financial contributions to the church for tax purposes, and distributes contribution records that shows a beginning and ending "balance" for each member. This practice directly contradicts the Bible's command about giving alms before men (Matthew 6:1-4).

The pastor of an incorporated church may therefore inform the congregation of the tax-deductibility of their gifts only if he warns them that a tax write-off may be the only reward they will receive (Matthew 6:4).

The Incorporated Church Surrenders its God Given Laws

Man, created by God in the image of God, was granted by God certain "unalienable rights" which are constitutionally protected. Corporations, created by the State, are not "real" or "natural" persons and, therefore, have no constitutionally secured rights!

It is a common belief that an incorporated church may refuse to disclose its financial records, particularly its tithing records, to the State should such be demanded. However, such a naive belief will not protect the church or its members from harassment from the Internal Revenue Service or any other federal agency: "[A] corporation is not considered as a person within that clause of the fifth amendment to the constitution which protects a "person" against self-incrimination" Len Young Smith and G. Gale Roberson, Smith and Roberson's Business Law, p. 787.

According to the ruling of the Supreme Court: "There is a clear distinction in this particular between an individual and a corporation and that the latter has no right to refuse to submit its books and papers for an examination at the suit of the State. While an individual may lawfully refuse to answer incriminating questions unless protected by an immunity statute, it does not follow that a corporation vested with certain privileges and franchises, may refuse to show its hand when charged with an abuse of such privileges. Hale v. Henkel, 201 U.S. 74-75.

"Whenever a corporation makes a contract it is the contract of the legal entity ...The only rights it can claim are the rights which are given to it in that charter, and not the rights which belong to its members as citizens of a state" Bank of Augusta v. Earle, 13 Pet. 586).

In other words, a corporation has no rights, only privileges which may be revoked any time its creator sees fit. Individual members ("share-holders" or "corporate franchises") also surrender their rights on account of their legal union with the corporation. Thus, the IRS may audit the corporation's financial records at any time, because, as one former IRS commissioner stated, "The churches... hold in trust that which belongs to the government." This is the law, and it cannot be changed by amendments to church by-laws, or even by the good intentions of church leaders.

Can an incorporated church refuse to disclose its financial records to the IRS on the grounds that it did not know that such consequences would arise from incorporation? Unfortunately, the answer is no. Incorporation is a form of "non-positive," or "contract law." According to Black's Law Dictionary, p.322, a contract is "an agreement between two or more persons which creates an obligation to do or not to do a particular thing." The laws comprising the contract do not apply to either party until the contract is agreed upon, at which time it is legally binding upon both. Claiming ignorance of the specifics of the contract will not excuse either party from their obligation once the contract is signed:

"As a general proposition, a party is held to what he signs.... One cannot obtain a release from contract liability upon the ground that he did not understand the legal effect of the contract" Len Young Smith and G. Gale Roberson, Smith and Roberson's Business Law, p. 70

By incorporating, the pastor and elders of a church need to realize that they have, in effect, signed a contract with the federal government which they have become legally and morally liable to obey (Romans 13:1). They cease to exist as a "real" First Amendment association with "unalienable" rights, and are transformed into a federal institution under the complete jurisdiction & control of "Acts of Congress." A church can no more change the nature of a contract after the fact than a private individual.

The Unbiblical Status of Limited Liability

Finally, let us take a brief look at the biblical problems of church incorporation. As we have seen, the Bible teaches that the Christian Church is a spiritual corporation that derives its existence from its Head, who is Christ. Each individual member is in covenant with the others and exercises their gifts for the benefit of the collective group. This is the concept of unity in diversity. The whole derives its substance from its individual parts. Therefore, the actions of the individual indirectly affect the whole.

We see this concept of covenantalism numerous times throughout Scripture. For example, in the Old Testament economy, the sin of Achan brought judgment upon the entire nation of Israel (Joshua 7), and the righteous act of Phineas brought God's blessings (Numbers 25). This principle did not pass away with the Old Testament economy, however. In 1 Corinthians 5, Paul exhorted the Corinthian church to "put away" from them the unrepentant adulterer with the following illustration (verse 6b-7a).

The corrupting influence of sin should never be underestimated, and God's judgment on an entire congregation is risked if one of its members is allowed to continue in open rebellion against His Word. This is why it is so important for the elders to protect the Church from moral and spiritual disintegration by removing the ungodly member via excommunication. Likewise, it is equally the responsibility of individual members of a church to disassociate themselves from an apostate church, so that they might not "partake of her sins" (Revelation 18:4).

Church incorporation flies in the very face of biblical covenantalism. This is seen primarily in the privilege of "limited liability," which means that the corporation cannot be held legally responsible for the actions of the individual members: "A corporation... should be distinguished from the individuals who compose it and those who control it as well as from the property which it owns" Len Young Smith and G. Gale Roberson, Smith and Roberson's Business Law, p. 785.

God certainly did not deal with the nation of Israel on the basis of limited liability, so why should modern churches seek this unbiblical status for themselves? In giving the church her orders, Jesus promised: "All power is given unto me . . . I am with you alway." (Matthew 28:18,20). Apparently, this was not enough for the church. The State promised to protect the church from lawsuits and other attacks from without if only she would incorporate. Turning her back on the promised care of her Bridegroom, Jesus Christ, the church accepted her lover's "protection."

Supposedly, limited liability protects the individual members from personal lawsuit. However, this is simply not the case. Franchises of a corporation are just as susceptible, if not more so, to a lawsuit than any other organization. Furthermore, the incorporated church itself greatly increases its own susceptibility to a lawsuit due to the fact that a business is far more likely to be sued than is a strictly religious organization. Unincorporated churches are immune, they cannot sue, nor be sued by, anyone.

Corporations have no Soul

"Man has been created by, in, and for, the Word of God, and this makes him the being who is responsible. Masses, collectives, and species have no responsibility; they are not capable of assuming responsibility. They [corporations] cannot commit trespass nor be outlawed nor excommunicated, for they have no souls." 10 Rep.32 b.

"Human beings are called 'natural persons' to distinguish them from 'artificial' personas or corporations. To acquire the status of artificial or legal personality, the group seeking it must be incorporated, i.e., must obtain a formal state license. In modern civil law, while incorporation is necessary for some purposes, chiefly in commercial law, and group of persons, acting as a unit, may be treated as an artificial or legal person." Warren Co. v. Heister, 219 La. 763, 54 S.2d 12." Radin Law Dictionary (1955), page 249.

Can you imagine the early church of the Apostles passing the hat to help Caesar out? To ask the Lord's church to collect a tax to finance every wicked thing on this earth, including the murder of millions of babies each year, is tyranny at its worst.

Because a 'person' has no access to any law outside the law creating it, then no constitutional arguments can ever be raised by the person, or corporation, successfully. Government is the person created by constitutions and no officer can make any arguments against the power establishing his office by using law which is not given him by the superior power. In the same vein, a 'person' created by legislation can use no law outside the law creating it for any arguments against the superior power creating 'it'.

Organism or Organization?

Is the body of Christ an Organism or an Organization? An organism is a living thing. I am living, and I am part of the body of Christ. The body of Christ is the church. An incorporated Church is not an organism, but an organization. An organization is a creature of the State, and as such must hold allegiance to the creator of their organization.

All those who join with an organization that is under corporation status accept the debt of that organization, and become subject to that debt of another. I do not need to tell you what scripture tells us about this debt. Borrowing money, for expansion, from the ungodly bankers, is not a biblical principle and, as such, cannot be blessed by God.

Black's Law Dictionary, 5th Edition, defines 'organization' as a "corporation or government subdivision or agency, business trust, partnership or association…or any other legal or commercial entity". This definition shows that an organization (even if it functions as a church) is recognized as commercial and public; an incorporated Church is legally interpreted as a commercial entity. But didn't Christ say "make not my Father's house an house of merchandise" (John 2:16)?

The real benefit the 501(c)(3) Church looks for with incorporation is the ability to borrow large amounts of debt capital. This enslaves every man, woman, and child whose name appears on the membership roles of the Church. How can this be? Because every officer and member of the Church pledges themselves as surety for the commercial debts of the Church, whether they know it or not. Why is this? Because the member's name that appears on the Church rolls is a beneficiary of the Church 'services', which are also construed as commercial by the government (the term 'service' is a commercial term, and means either to get paid for an occupation, or it means an act giving assistance or advantage to another, which results in a benefit). Additionally, the 'tax-deductible contributions' are further evidence of the commercial connection to the corporation.

A maxim of law states: "He who accepts the benefit must also bear the burden," meaning if one accepts any benefit of the incorporated Church one is liable for the debts and acts of the church leadership. If the Church is sued and a cash settlement is ordered by the court, there is virtually no limit as to how far the court can extend its power to collect from the members, even if they are not the officers responsible for committing the civil crime. "For my yoke is easy, and my burden is light" (Mat.11:30).

"Although it was once said that 'a corporation is not indictable, but the particular members are' [Anon., 12 Mod. 559], it is now well settled that a corporation may be indicted for omission to perform a public duty imposed upon it by law." Reg. V. Birmingham & G. Ry. Co., 3 Q.B. 233; New York & G.L.R. Co. v. State, 50 N.J.Law 303, 13 Atl. 1, affirmed in 53 N.J.Law, 244, 23 Atl. 168.

In Jesus' day, the chief priests bound themselves to Caesar (John 19:14-15). Who were they a priest of? Caesar. Who did they minister for? Caesar. Who does the 501(c)(3) Church now minister for? "We have no king but Caesar." They have a United States flag in every one of their Churches. "We don't make political statements from the pulpit anymore, we don't ever preach against the one for whom we minister. We don't want to lose our tax-exempt status!" So, we had fascism in Christ's day, the same fascism we have today.

Conclusion

It is time for the churches in America to wake up to the fact that they have seriously compromised the headship of Christ by incorporating. The very first sentence of the Bill of Rights states, "Congress shall make no law regarding an establishment of religion." No law means no law. Christian churches do not need to obtain a special "operating license" to avoid taxation; the government simply cannot tax them to begin with! The church is already immune to all taxation.

The Church of Jesus Christ is forbidden by Scripture to merge with the State because the two exist as separate entities. The State is not to claim jurisdiction over the Church, and the Church is not to place herself in such a position. The Church does not need to request of the State permission to exist as a legal entity. Its charter is the Bible, and its article of incorporation are the commandments of God. As Jesus said, "No man can serve two masters" (Matthew 6:24). If this principle applies to an individual, how much more so to his church?

Church members should confront their pastors and elders on these issues. Do not let them simply brush you off with the claim that the subject has "been studied already," or that "we have always done it this way." Challenge them to produce a copy of the IRS statutes which state that a Christian church must incorporate as a 501(c)(3) organization in order to carry out its God-ordained functions. They will not be able to do this, because such a law simply does not exist. You may find yourself unwelcome in your church, but at least you will have the satisfaction of having stood for the truth and for the sole prerogative of Christ to govern His own Church.

No comments:

Post a Comment