Dear CIGAs,

The world is not going to end. It already has, and you have not noticed.

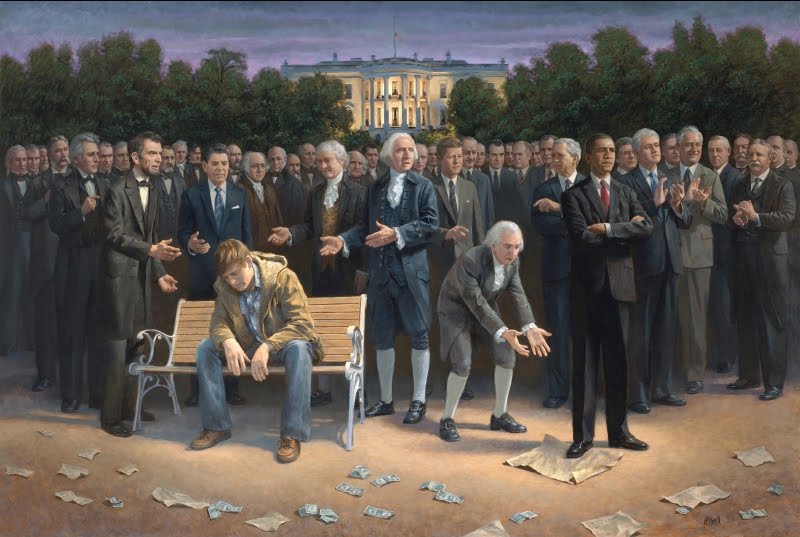

They will never learn, but why should they? These institutions are gambling with your money, not theirs. They win and they whack it up between themselves. They go wrong you lose in the trillions. There is a potential for an uncontrolled nuclear financial reaction in this outrageous form of greed driven madness. No longer does the Edison and Tesla of the world seek to invent a better world, just a better way to beat the markets using universal energy of the leverage in OTC derivatives via super computers. This is going misfire very badly. Each generation is crazier than its predecessor in their greed and penchant for money and power. The builders of real businesses are frowned upon. Our financial kids are downright dangerous. They seek not to better the world but to destroy all that is good in it for personal profit. The only invention welcome is one that means more paper profit. They have no limits on their desires. They cannot be satisfied by any amount. Their battle cry is "More at any Cost." They will cause a chain reaction financial dark energy that cannot be stopped by any central bank or all central banks together. Maybe we are going into a Super Financial Nova followed by a permanent Economic Black Hole where prosperity once existed? Maybe the rebellious IMF knows this.

OCC’s Quarterly Report on Bank Trading and Derivatives Activities

First Quarter 2015

Highlights:

· JPM and Citi are still competing for top derivative gambler at about $56 Trillion each

· At table 2, tiny Morgan Stanley has a derivative book of $35.2 Trillion

· At graph #12, (other) precious metals derivatives (i.e. silver) jumped from about $22.4 Billion in Q4’2014 to about $75.6 billion in Q1’2015

· At table 9, Citi’s (other) precious metals derivatives (i.e. silver) jumped from about $3.9 Billion in Q4’2014 to about $53 billion in Q1’2015!

No comments:

Post a Comment